By: Arvid Tchivzhel, SVP of Technology and Katherine Ruane, Director of Strategic Marketing at Mather

May 7th, 2025

For local outlets that aren’t The New York Times, deciding whether to cover national stories—especially polarizing ones like Trump—can be tricky. While these issues dominate headlines and spark intense public interest, it’s not always clear whether they help drive digital subscriptions for local publishers. In fact, the answer depends largely on a publisher’s size, resources, and ability to bring a local lens to national events.

Major publishers are generally better equipped to turn national coverage into subscription gains. They have the staff and scale to report on these stories in ways that attract and retain readers. Smaller publishers, however, often lack the resources to compete in the national arena. As a result, they may miss out on audience interest simply because they can’t afford to chase it. For these reasons, leaning into unique local reporting may still be the most sustainable strategy.

But before we draw conclusions, it’s worth revisiting the most famous example of national coverage driving digital growth: the Trump Bump.

The “Trump Bump”

The “Trump Bump” became a well-known phenomenon in the media world—referring to the surge in digital subscriptions for many national news outlets, one of its biggest beneficiaries being The New York Times.

In the wake of the 2016 election, the NYT added 280,000 new digital subscribers in Q4, followed by another 316,000 in Q1 2017. The next record-breaking moment came in 2020, not from politics, but the pandemic. In Q1 of that year, the NYT brought in 587,000 digital subscriptions—the largest quarterly gain in its history at the time.

Fast forward to another election cycle in Q4 2024, and the NYT once again saw a lift, netting 350,000 new subscribers. Ahead of Q1 2025, growth expectations were lowered due to competition from other national players like CNN and The Verge. However, NYT beat forecast and added 250,000 net subscribers citing the news cycle and bundling strategy as primary drivers for growth.

Not every bump lasts, but the pattern is clear: national moments have the power to drive significant audience engagement and growth. The question is—can local publishers tap into that same momentum?

What the Data Shows

To explore this, we analyzed Q1 2025 content performance data from nearly 100 news organizations to understand how national topics perform—who they benefit, and under what conditions.

We conducted a keyword analysis centered on the recent election cycle and the Trump administration (e.g., “Trump,” “Musk,” “Border”, “Tariff”, etc.) to flag nationally focused content and applied a custom algorithm to identify whether articles were locally produced or syndicated. We then evaluated performance across key metrics like page views, path to conversion, and last-click conversion to assess which types of coverage drive engagement and subscriptions.

What We Found:

- Original, locally written content drives results.

Articles by local staff generated the majority of engagement—63% of page views and 74% of last-click conversions—underscoring the power of trusted, local voices.

- National stories don’t guarantee conversions—especially for smaller outlets.

While 22% of local news publisher articles covered national topics, these drove only 8% of total conversions. For smaller publishers, national stories tend to drive fewer conversions—despite making up a larger share of their output.

- Larger publishers are better positioned to capitalize.

Big outlets not only get stronger performance from national content, they’re more likely to produce it locally—giving them a competitive edge smaller newsrooms often can’t match.

At first glance, the data might suggest local publishers should steer clear of national coverage. But the picture is more complex. The performance of national stories varies by publisher size—pointing to a clear divide in who benefits and why.

The Uneven Playing Field of National News

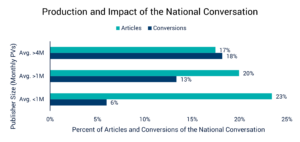

- Larger publishers see a near one-to-one return on national content

Those with over 4 million monthly article views (5% of our dataset) devoted 17% of their content to national topics, which generated 18% of total conversions (Chart 1).

- Smaller publishers invest more but gain less

Outlets with under 1 million monthly article views dedicated 23% of their content to national topics, yet those stories drove only 6% of conversions (Chart 1).

Chart 1

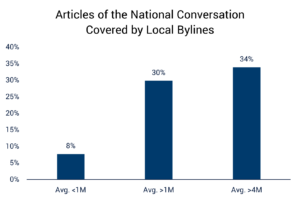

- Larger Publishers Are Better Equipped to Localize National News

Among larger outlets, 34 percent of national articles were written by local staff—compared to just 8 percent at the smallest publishers. This gap reflects a key resource divide: bigger newsrooms are better positioned to bring national stories home in ways that resonate with local audiences (Chart 2).

Chart 2

Together, these findings underscore a clear divide: while larger publishers can tap into national interest and translate it into local relevance and revenue, smaller publishers often struggle—not for lack of effort, but due to structural resource constraints. When it comes to national conversations, the publishers seeing the greatest return are those equipped to localize that coverage effectively.

Closing the Gap: Helping Small Newsrooms Succeed with National Coverage

While we haven’t seen clear signs of a new Trump Bump in the most recent election cycle, digital growth remains a top priority—and decisions around national coverage continue to shape performance strategies across the industry. That’s why supporting local newsroom staff in covering the national conversation is more important than ever.

National issues like federal policy have a real impact on local communities, but syndicated stories often miss the nuance and local relevance readers expect. Audiences respond more deeply to stories told by voices they know and trust. To make this kind of reporting sustainable, local publishers need funding—and fortunately, support exists. Organizations like the Knight Foundation, Press Forward, Google News Initiative, and the American Press Institute offer grants specifically aimed at strengthening local journalism. Mather recommends focusing these resources on smaller publishers to help close the investment gap in underserved communities.

Still, long-term success requires more than grant funding.

Small publishers must build resilient, diversified revenue models that include digital and print subscriptions, advertising, philanthropy, and community-based efforts like events and sponsorships. Developing these streams is vital for navigating continued industry shifts.

At the same time, as major platforms and LLM providers increasingly partner with large media brands, smaller outlets risk falling further behind. Many lack the in-house expertise and tools needed to keep pace—and in some cases, outdated or underpowered technology slows progress instead of enabling it.

But smaller publishers aren’t without options. With the right mix of investment, strategy, and support, they can lean into their competitive edge—delivering the kind of local insight and trusted reporting that national brands simply can’t replicate. By equipping small newsrooms with the tools, training, and partnerships they need to thrive, we can help ensure that every community has access to journalism that’s not just relevant, but resilient.

Mather helps level the playing field. With scalable tools like the Sophi Dynamic Paywall Engine and access to hands-on strategic support, we empower smaller publishers to grow audience, boost revenue, and thrive in a rapidly changing media landscape.

Let’s connect—see how Mather can help you build smarter, stronger strategies for growth.